1040 - Individual. Calculate Your Taxes Now.

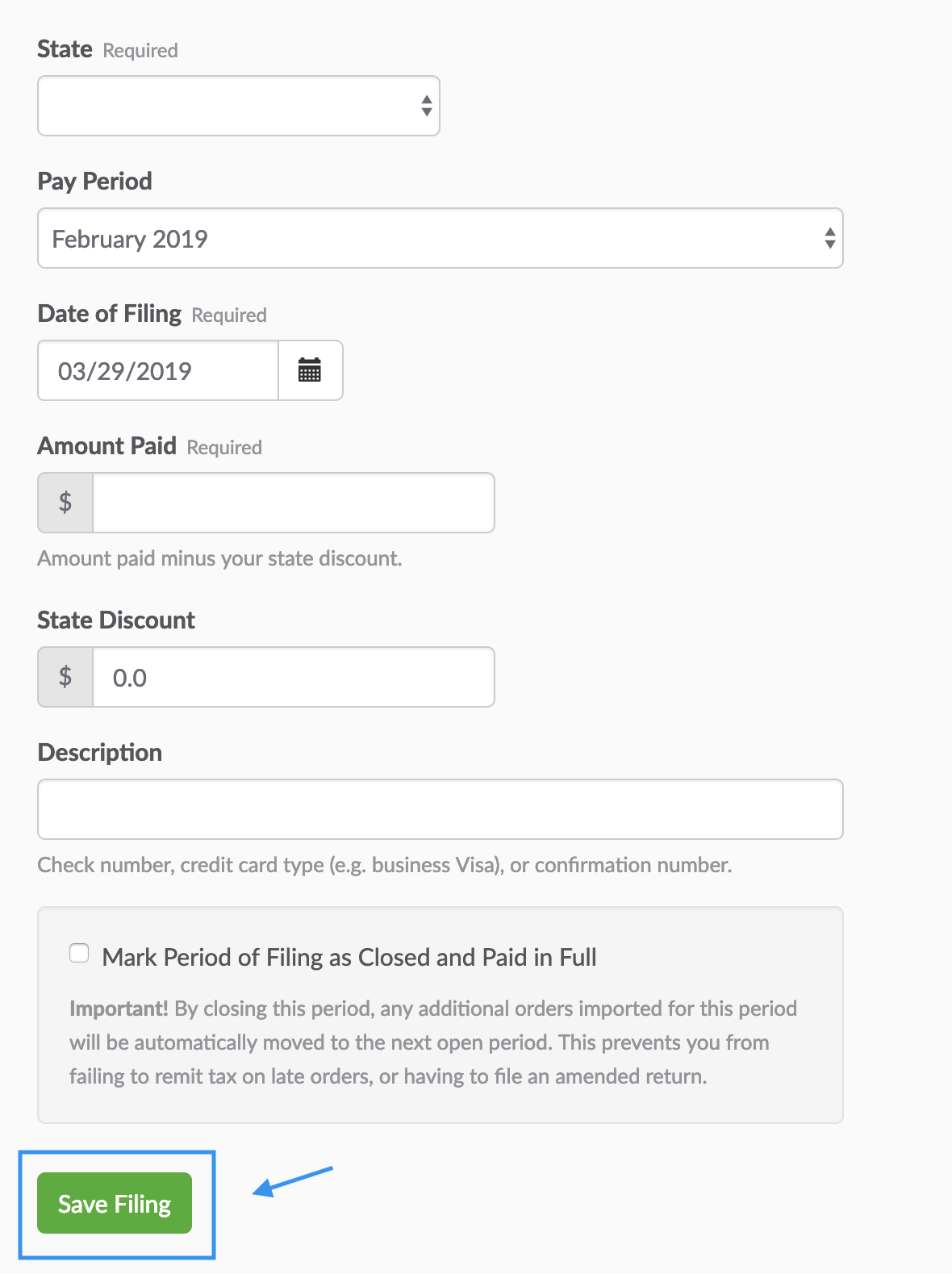

How To File A California Sales Tax Return Taxjar

What is your hurry though.

. Get your tax refund up to 5 days early with TurboTax. The tax agency noted that while individual taxpayers may get their returns prepared using a tax professional before the start date or use software programs the processing. You can file Form 1040-X Amended US.

Although the IRS extendedto March 4 2019the deadline for furnishing Forms 1095-B and 1095-C to individuals no similar extension applies to filing with the IRS see our Checkpoint article. Recently the GST Councils 47th meeting was held in Chandigarh on June 28th and 29th 2022 under the chairmanship of the Union Finance. Paper filings are due February 28 2019.

Free Federal 1799 State. Use web pay for businesses to make your payment. 1 July 2022 SARS has made significant changes to the 2022 Tax Filing Season.

Easily Fill Out All 2019 State and Federal Tax Forms Online. In the past irs has shut down its efile service in late november to mid december and usually reopens prior year efiling with the opening of the next years efiling season. Ad Prepare your 2019 state tax 1799.

Maximize Your Tax Refund. Easy Fast Secure. Complete sign and mail your 2019 return to the IRS - FileIT Now.

Usually in mid to late january. Even when you e-file your 2019 tax return be aware that your return is just going to sit on a server waiting until the IRS begins to. We accept and process e-file returns year round.

To provide feedback on this solution please login. Filing Season 2022 for individuals is now open. The CBIC vide Notification No.

Ready set file. If you live in Maine or Massachusetts you have until April 19 2022 to file your tax return due to the Patriots Day holiday in those states. November 16 2019 - January 27 2020.

7 and will begin accepting individual returns on Jan. You can find more details about the shutdown including what you can e-file and when below. If you are in the auto-assessment group you will receive a.

The Internal Revenue Service IRS has announced that tax season will open on Monday January 27 2020. E-filing is supposed to open sometime today on January 3. It shuts down once a year for maintenance.

Foreign Bank and Financial Accounts FBAR. Return Due Dates and Deadlines. File and pay on time April 15th to avoid penalties and fees.

IndividualFiduciary due dates for calendar year filers. Load and Complete the Forms Before You Mail Them to the IRS. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

The filing deadline to submit 2021 tax returns is April 18 2022. Preparing for the April Deadline. When can I file for 2019.

The IRS has announced that it will begin accepting 2019 e-filed business returns on Jan. Ad Prevent Tax Liens From Being Imposed On You. 100 Free Federal for Old Tax Returns.

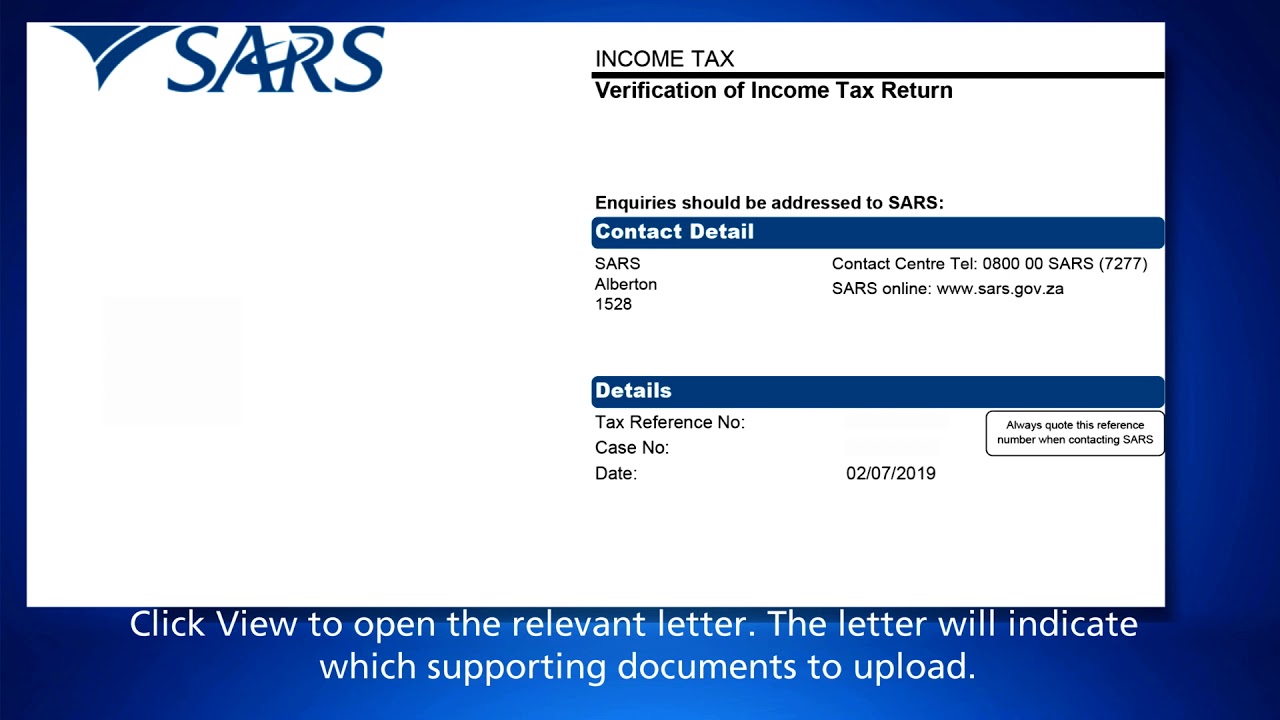

December 26 2019 - January 7 2020. 212019 Central Tax dated April 23 2019 as amended to provide various extensions to the taxpayers for filing Form GST CMP-08 ie statement for payment of self-assessed tax. SARS eFiling is a free online process for the submission of returns and declarations and other related services.

All other prior returns must be paper-filed. If April 15 falls on a weekend or legal holiday you have until midnight the next business day following April 15 to timely file either Form 4868 or your tax return. Is the IRS accepting eFile 2020.

Tax Electronic Filing Deadline Guidepdf. CPA Professional Review. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR.

The shutdown dates are. The IRS accepts e-file of individual and business returns for the current and two prior years - for example during the 2021 filing season tax year 2020 2018 2019 and 2020 returns will be eligible for e-file. Tax Calculator For 2019 Taxes.

This year over 3 million taxpayers have been auto-assessed by SARS and will not have to file a tax return if they are satisfied with the outcome. 2020 was unusual as the prior years efile service didnt open up until april or may after that reopening date the prior-year efile. If you timely file Form 4868 you have until October 15 to timely file your return.

California Individual and Fiduciary income tax returns have an automatic six-month extension date for timely filing. You can also find information from the IRS on the IRS Modernized e-File MeF Status page. Thus the deadline for electronic filing is April 1 2019.

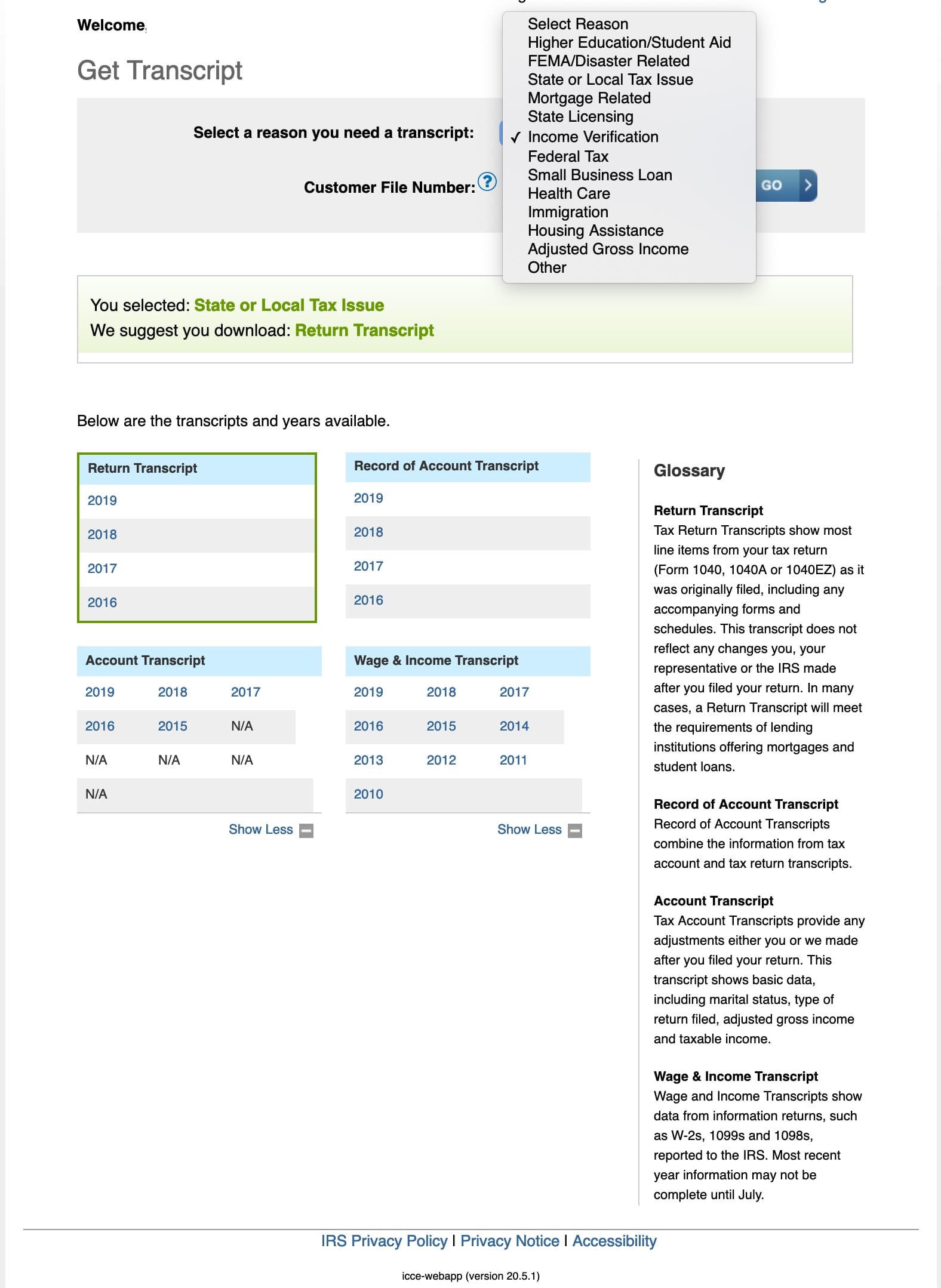

The IRS will begin accepting paper and electronic tax returns that dayJan 6 2020 Heres what you get from going to the IRS. The 2019 Calculator Help You Complete Your 2019 IRS Paper Tax Forms. This free service allows taxpayers tax practitioners and businesses to register free of charge and submit returns and declarations make payments and perform a number of other interactions with SARS in a secure online environment.

Will I Get Audited If I File An Amended Return H R Block

Itr Filing Deadline Nears How To File Income Tax Return Online Income Tax Return Tax Return Income Tax

Irs Tax Return Forms And Schedule For Tax Year 2022

Grace Periods For Retransmission Of Rejected E Filed Returns And Extensions

Income Tax E Filing 2020 ഇന 10 ദ വസ മ ത ര Youtube Income Tax Income Tax

The Irs Made Me File A Paper Return Then Lost It Tax Policy Center

Tax Deadline 2022 When Is The Last Day To File Taxes 2022 Turbotax Canada Tips

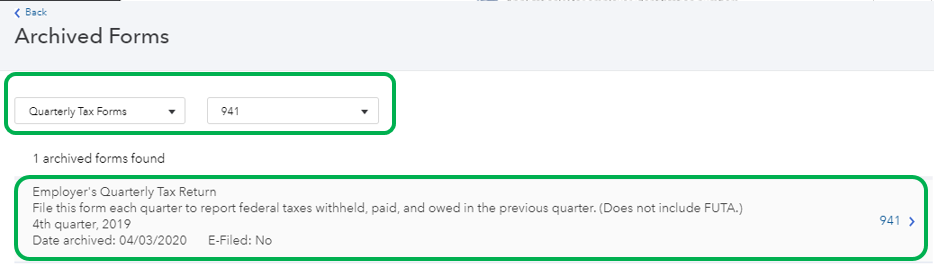

Tax Return Copies Can Be Downloaded From Efile Com Account

E File Itr Itr Amp Tax Filing Online Very Simpale With Allindiaitr How To Filing Itr Income Tax Return 31st Mar Income Tax Return Tax Return Income Tax

How To File An Extension For Taxes Form 4868 H R Block

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Itr Filing Is No Big Deal For Taxpayers Using E Lite Filing Services Income Tax Income Business Software

2021 2020 2019 Tax Forms And Documents Via A Transcript

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

California Tax Forms H R Block

Sars Efiling How To Submit Documents Youtube

Sars Efiling How To Submit Your Itr12 Youtube